Diesel generator global market report 2025

Diesel Generator Global Market Report 2025 – By Type (Small Diesel Generator, Medium Diesel Generator, Large Diesel Generator), By End User (Industrial, Commercial, Residential), By Application (Standby Backup Power, Peak Shaving, Continuous Load), By Mobility (Stationery, Portable), By Power Rating (75 kVA, 75-375 kVA, 375-750 kVA, Above 750 kVA) – Market Size, Trends, And Global Forecast 2025-2034

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

What Is Covered Under Diesel Generator Market?

The diesel generator is used to produce electric energy by using an Electric Generator with a diesel engine. It is mostly used for emergency power supply in case of an electric shutdown. The primary fuel of a diesel generator is liquid fuel or natural gas.

The main types of diesel generators are small diesel generators, medium diesel generators, and large diesel generators. The small diesel generators are Portable generators with a power of 0–75 kVA. Small diesel generators are mostly air-cooled and provide a backup power source for mobile applications such as mining sites, farming requirements, and professional contractors. Diesel generators can be stationary or portable and offer power ratings from below 75kVA, 75-375kVA, 375-750kVA, and above 750kVA. They are mostly used for standby backup power, peak shaving, and continuous load by end-users such as Industrial, commercial, and residential.

What Is The Diesel Generator Market Size 2025 And Growth Rate?

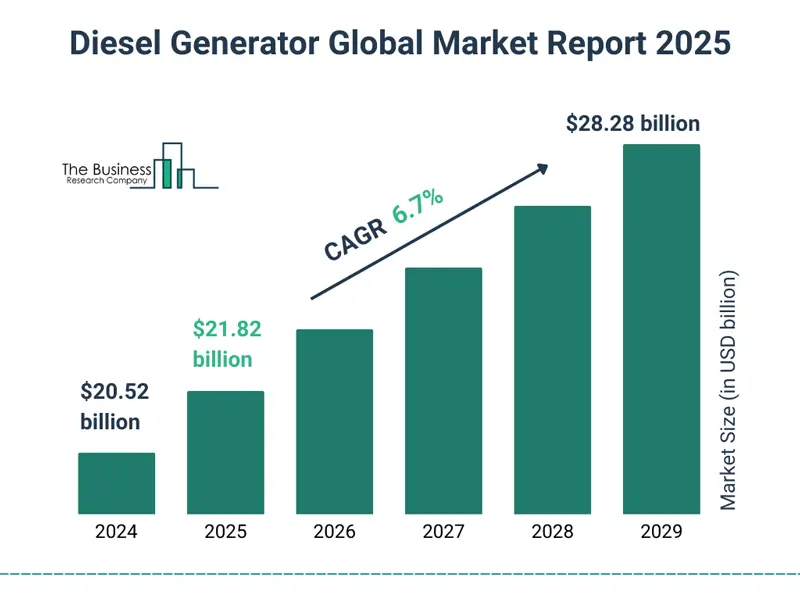

The diesel generator market size has grown strongly in recent years. It will grow from $20.52 billion in 2024 to $21.82 billion in 2025 at a compound annual growth rate (CAGR) of 6.3%. The growth in the historic period can be attributed to strong economic growth in emerging markets, rapid industrialization, an increase in energy demand and consumption, and a rise in focus on electricity generation using fossil fuel energy sources.

What Is The Diesel Generator Market Growth Forecast?

The diesel generator market size is expected to see strong growth in the next few years. It will grow to $28.28 billion in 2029 at a compound annual growth rate (CAGR) of 6.7%. The growth in the forecast period can be attributed to the expanding construction industry, thriving growth of the manufacturing industry, and remote work revolution. Major trends in the forecast period include improving the efficiency of diesel generators, developing rental generators, hybridization of diesel generators, designing compact and mobile solutions, and integration of advanced technologies such as remote monitoring, predictive maintenance, and data analytics.

How Is The Diesel Generator Market Segmented?

The diesel generator market covered in this report is segmented –

1) By Type: Small Diesel Generator, Medium Diesel Generator, Large Diesel Generator

2) By End User: Industrial, Commercial, Residential

3) By Application: Standby Backup Power, Peak Shaving, Continuous Load

4) By Mobility: Stationery, Portable

5) By Power Rating: 75 kVA, 75-375 kVA, 375-750 kVA, Above 750 kVA

Subsegments:

1) By Small Diesel Generator: Portable Diesel Generators, Residential Diesel Generators

2) By Medium Diesel Generator: Industrial Diesel Generators, Commercial Diesel Generators

3) By Large Diesel Generator: High-Capacity Diesel Generators, Standby Power Generators For Large Facilities

What Is Driving The Diesel Generator Market? Diesel Generators Thrive On The Back Of Construction Industry Expansion

The expansion of the construction industry is expected to be a key driver of the growth of the diesel generator market in the forecast period. As construction projects expand, reliable power sources are essential to maintaining operations in various stages of development, and diesel generators serve as critical backup power solutions, ensuring uninterrupted operations in construction sites where grid power may be unreliable or unavailable. For instance, in August 2023, according to a report published by the U.S. Census Bureau, a primary agency of the United States Federal Statistical System, construction expenditure accounted for $1,938.4 billion in June 2023, indicating a 3.5% percent increase from the estimated expenditure of $1,873.2 billion in June 2022. Further, in March 2023, according to Oxford Economics, a UK-based provider of global economic forecasting and econometric analysis, the global construction output is estimated to grow from $9.7 trillion in 2022 to $13.9 trillion by 2037. Therefore, the expanding construction industry will drive the growth of the diesel generator market going forward.

What Is Driving The Diesel Generator Market? Diesel Generators As Crucial Backup Solutions For Seamless Remote Work Operations

The remote work revolution is expected to propel the growth of the diesel generator market in the forecast period. The practice of remote working, often referred to as telecommuting or teleworking, has gained significant traction in recent years and has been further accelerated by the COVID-19 pandemic. As more people work remotely, businesses may seek reliable backup power solutions to ensure continuous operations, especially in areas with unreliable grid power, ultimately contributing to the need for backup power sources such as diesel generators to maintain productivity during power outages and enhance their market demand. For instance, in June 2023, according to Forbes, a US-based renowned business publication, 12.7% of full-time employees were operating in a remote work model. Additionally, 28.2% of employees have embraced a hybrid work approach. By 2025, projections indicate that around 32.6 million American professionals, or roughly 22% of the workforce, will be engaged in remote work. Therefore, the remote work revolution will drive the growth of the diesel generator market in the forecast period.

Who Are The Major Players In The Global Diesel Generator Market?

Major companies operating in the diesel generator market include Mitsubishi Heavy Industries Ltd, Caterpillar Inc, Cummins Inc, Rolls-Royce Holdings plc, Generac Holdings Inc, Aggreko, Atlas Copco AB, Yanmar Co. Ltd., Wartsila Corporation, Doosan Portable Power, Wuxi Huayou Power Equipment Co. Ltd, GIANT Power OEM Co. Ltd, Detra (HK) International, Jiangsu Dohigh Generator Trading Co. Ltd, Shangyu Diesel Engine Co. Ltd, Yanmar Holdings Co. Ltd, Kubota Corporation, Honda India Power Products Limited, Enrogen, Excel Power Ltd, JS Power, German Generator GmbH, Fischer Panda GmbH, Energy XPRT, Andoria-Mot Ltd, Dfme Sp. Z O. O, Poland Generators Manufacturers, Kohler Co, Powerhouse Diesel Generators Inc, Smith's Diesel and Power Systems, BC Diesel Generators, GAL Power Systems, MWM Motors Diesel Inc, Tupy S.A, Soenergy Sistemas Int De Energia, Geraforte Grupos Geradores LTDA, Jubaili Bros, Ultimate Power Solution Fzc, AQT Generators, Ade Power, Algen Power Generation, Mikano International Limited

What Are The Key Trends Of The Global Diesel Generator Market? Technological Advancements Drive Innovation In The Diesel Generator Market

Major companies operating in the diesel generator market are focused on providing technologically advanced solutions such as ultra-silent generators to strengthen their market position. Ultra-silent generators are designed to operate with minimal noise, making them ideal for use in noise-sensitive environments while providing reliable power output. For instance, in May 2024, Trime, an Italy-based design and manufacture of innovative and eco-friendly lighting solutions, launched a new range of diesel-powered generators, offering a power range of 6 kVA to 670 kVA, featuring advanced engines from Kohler Stage V, Yanmar, FPT Iveco, and Perkins. Designed for the UK and Ireland hire markets, these ultra-silent generators provide versatile single and three-phase outputs for various applications and are built to the same high standards of reliability and durability as Trime's previous lighting tower products.

What Are The Key Trends Of The Global Diesel Generator Market? Advancements In Diesel Generators Embrace Remote Monitoring And Predictive Maintenance

Digital technologies have boosted the diesel generator market and manufacturers are investing in R&D to develop sophisticated diesel generators that integrate advanced technologies such as remote monitoring, predictive maintenance, and data analytics for better optimization of fuel efficiency. For instance, in August 2022, Caterpillar Inc., a US-based manufacturer of construction and mining equipment, engines, and industrial turbines, launched Three New Standby Diesel Generator Sets. The Three New Standby Diesel Generator Sets provide reliable backup power for commercial, industrial, and residential applications. Designed for high capacity and fuel efficiency, these generators feature automatic start capabilities and a durable construction, ensuring uninterrupted electricity supply during outages. Additionally, IT includes Cat Connect hardware and a Remote Asset Monitoring subscription with new generator sets, enabling users to track performance, receive alerts, troubleshoot remotely, and analyze data for operational improvements via a web interface or mobile app.

Diesel Generator Market Merger And Acquisition: DTGen Strengthens Presence With Strategic Acquisition Of Power Electrics Generators (PEG)

In March 2022, DTGen, a UK-based company offering diesel and gas generators, announced the acquisition of Power Electrics Generators (PEG) for an undisclosed amount. Under this deal, DTGen will acquire the sales and projects division of PEG and aims to expand its capacity and expertise and have national coverage across the UK, with locations in the Midlands, Scotland, and also the south. Power Electrics Generators is a UK-based company offering a range of diesel generators, fuel, and control systems, and enclosures and also provides diesel generator sales, hire, parts, and service.

Regional Outlook For The Global Diesel Generator Market

Asia-Pacific was the largest region in the diesel generator market in 2024. The regions covered in the diesel generator market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the diesel generator market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

What Defines the Diesel Generator Market?

The diesel generator market consists of sales of portable generators, inverter generators, and standby generators. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

How is Market Value Defined and Measured?

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

What is the Market Assessment and Strategic Outlook for the Diesel Generator Industry?

The diesel generator market research report is one of a series of new reports from The Business Research Company that provides diesel generator market statistics, including diesel generator industry global market size, regional shares, competitors with a diesel generator market share, detailed diesel generator market segments, market trends and opportunities, and any further data you may need to thrive in the diesel generator industry. This diesel generator market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Diesel Generator Market Report Forecast Analysis

| Report Attribute | Details |

| Market Size Value In 2025 | $21.82 billion |

| Revenue Forecast In 2034 | $28.28 billion |

| Growth Rate | CAGR of 6.7% from 2024 to 2033 |

| Base Year For Estimation | 2024 |

| Actual Estimates/Historical Data | 2019-2024 |

| Forecast Period | 2025 - 2029 - 2034 |

| Market Representation | Revenue in USD Billion and CAGR from 2025 to 2034 |

| Segments Covered | 1) By Type: Small Diesel Generator, Medium Diesel Generator, Large Diesel Generator 2) By End User: Industrial, Commercial, Residential 3) By Application: Standby Backup Power, Peak Shaving, Continuous Load 4) By Mobility: Stationery, Portable 5) By Power Rating: 75 kVA, 75-375 kVA, 375-750 kVA, Above 750 kVA Subsegments: 1) By Small Diesel Generator: Portable Diesel Generators, Residential Diesel Generators 2) By Medium Diesel Generator: Industrial Diesel Generators, Commercial Diesel Generators 3) By Large Diesel Generator: High-Capacity Diesel Generators, Standby Power Generators For Large Facilities |

| Regional Scope | Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa |

| Country Scope | The countries covered in the report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain. Additional countries that can be covered in the report are Bangladesh, Thailand, Vietnam, Malaysia, Singapore, Philippines, Hong Kong, New Zealand, Mexico, Chile, Argentina, Colombia, Peru, Austria, Belgium, Denmark, Finland, Ireland, Netherlands, Norway, Portugal, Sweden, Switzerland, Czech Republic, Poland, Romania, Ukraine, Saudi Arabia, Israel, Iran, Turkey, UAE, Egypt, Nigeria, South Africa. |

| Key Companies Profiled | Mitsubishi Heavy Industries Ltd, Caterpillar Inc, Cummins Inc, Rolls-Royce Holdings plc, Generac Holdings Inc, Aggreko, Atlas Copco AB, Yanmar Co. Ltd., Wartsila Corporation, Doosan Portable Power, Wuxi Huayou Power Equipment Co. Ltd, GIANT Power OEM Co. Ltd, Detra (HK) International, Jiangsu Dohigh Generator Trading Co. Ltd, Shangyu Diesel Engine Co. Ltd, Yanmar Holdings Co. Ltd, Kubota Corporation, Honda India Power Products Limited, Enrogen, Excel Power Ltd, JS Power, German Generator GmbH, Fischer Panda GmbH, Energy XPRT, Andoria-Mot Ltd, Dfme Sp. Z O. O, Poland Generators Manufacturers, Kohler Co, Powerhouse Diesel Generators Inc, Smith's Diesel and Power Systems, BC Diesel Generators, GAL Power Systems, MWM Motors Diesel Inc, Tupy S.A, Soenergy Sistemas Int De Energia, Geraforte Grupos Geradores LTDA, Jubaili Bros, Ultimate Power Solution Fzc, AQT Generators, Ade Power, Algen Power Generation, Mikano International Limited |

Sinotruk Parts

Sinotruk Parts  Shacman Parts

Shacman Parts  FAW Parts

FAW Parts  Dongfeng Parts

Dongfeng Parts  Foton Parts

Foton Parts  CHENGLONG PARTS

CHENGLONG PARTS  Golden Dragon Bus Parts

Golden Dragon Bus Parts  King Long Parts

King Long Parts  Yutong Parts

Yutong Parts  Higer Parts

Higer Parts  Zhongtong Parts

Zhongtong Parts  Ankai Parts

Ankai Parts

Mr. Perry Wu International Sales Director

Mr. Perry Wu International Sales Director